Vegas CFD: Unlocking The Secrets Of Financial Success

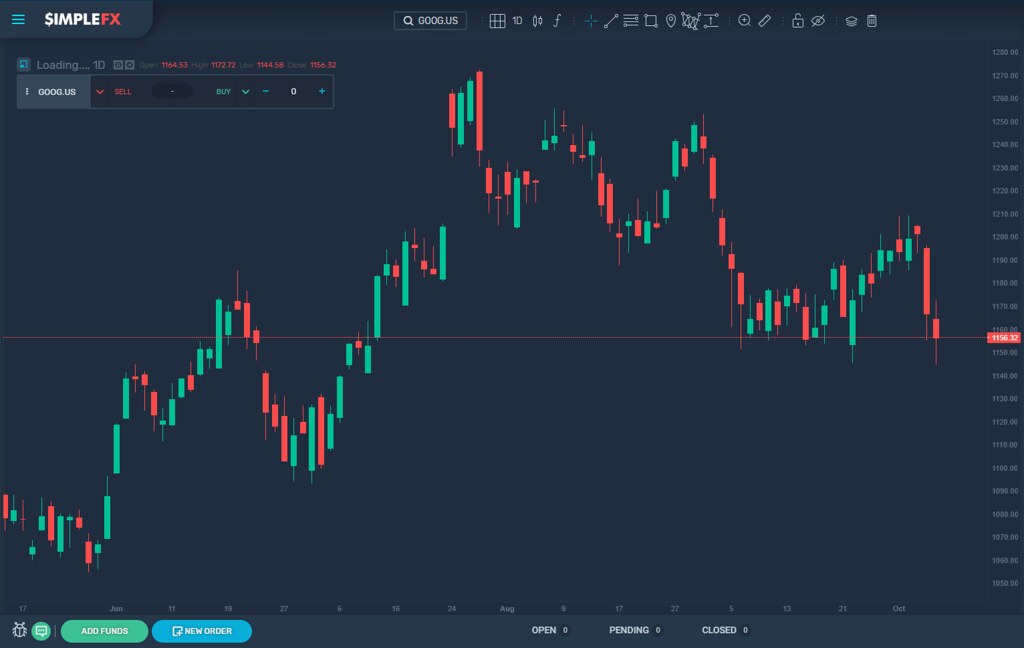

What is CFD trading, and how can it benefit you?

CFD trading, or Contract for Difference trading, is a form of derivative trading that allows traders to speculate on the price movements of various assets without actually owning the underlying asset. CFDs are traded on margin, which means that traders can gain exposure to a larger position size than their account balance would normally allow. This can amplify both profits and losses, so it's important to understand the risks involved before trading CFDs. CFD trading is available on a wide range of assets, including stocks, indices, commodities, and currencies.

There are many benefits to trading CFDs. CFDs are a relatively low-cost way to trade, as there are no stamp duty or other transaction fees. CFDs are also very flexible, as they can be used to trade both long and short positions. This means that traders can profit from both rising and falling markets. CFDs are also traded 24 hours a day, 5 days a week, which makes them a very accessible market for traders.

- Comprehensive Guide To Shemar Moores Journey And Impact

- Is Justin Timberlake Currently Incarcerated The Truth Revealed

CFD trading has been around for many years, but it has become increasingly popular in recent years as more and more traders have discovered the benefits of this versatile trading instrument. CFD trading is now one of the most popular forms of trading in the world, and it is likely to continue to grow in popularity in the years to come.

CFD trading is a complex and potentially risky activity. However, it can also be a very rewarding experience for those who understand the risks involved and who have a sound trading plan.

CFD Trading in Las Vegas

CFD trading, or Contract for Difference trading, is a form of derivative trading that allows traders to speculate on the price movements of various assets without actually owning the underlying asset. CFDs are traded on margin, which means that traders can gain exposure to a larger position size than their account balance would normally allow. This can amplify both profits and losses, so it's important to understand the risks involved before trading CFDs. CFD trading is available on a wide range of assets, including stocks, indices, commodities, and currencies.

- The Ultimate Guide To Bald Memes Meaning Origin And Impact

- The Ultimate Guide To Ape Movies In Chronological Order

- Leverage: CFDs allow traders to trade with leverage, which can amplify both profits and losses.

- Flexibility: CFDs can be used to trade both long and short positions, which means that traders can profit from both rising and falling markets.

- Accessibility: CFDs are traded 24 hours a day, 5 days a week, which makes them a very accessible market for traders.

- Regulation: CFD trading is regulated by the Commodity Futures Trading Commission (CFTC) in the United States and the Financial Conduct Authority (FCA) in the United Kingdom.

- Risk: CFD trading is a complex and potentially risky activity. It's important to understand the risks involved before trading CFDs.

CFD trading can be a great way to trade the financial markets, but it's important to understand the risks involved. CFDs are leveraged products, which means that you can lose more money than you deposit. It's important to have a sound trading plan and to manage your risk carefully.

Leverage

This is one of the key benefits of CFD trading. Leverage allows traders to trade with a larger position size than their account balance would normally allow. This can amplify both profits and losses, so it's important to understand how leverage works before trading CFDs.

- How does leverage work?

Leverage is a loan that is provided by the CFD broker. This loan allows traders to trade with a larger position size than their account balance would normally allow. For example, if a trader has an account balance of $1,000 and they use 10:1 leverage, they can trade with a position size of $10,000. - What are the risks of leverage?

Leverage can amplify both profits and losses. This means that traders can lose more money than they deposit. It's important to manage your risk carefully when trading CFDs with leverage. - How can I use leverage to my advantage?

Leverage can be used to increase your potential profits. However, it's important to remember that leverage can also magnify your losses. It's important to have a sound trading plan and to understand the risks involved before using leverage.

Leverage is a powerful tool that can be used to increase your potential profits. However, it's important to understand the risks involved before using leverage. CFD trading is a complex and potentially risky activity. It's important to have a sound trading plan and to manage your risk carefully.

Flexibility

This flexibility is one of the key advantages of CFD trading over traditional trading methods. In traditional trading, traders can only profit from rising markets by buying an asset and selling it later at a higher price. With CFDs, traders can also profit from falling markets by selling an asset short and buying it back later at a lower price.

- Going Long

When a trader goes long on an asset, they are betting that the price of the asset will rise. If the price of the asset does rise, the trader will make a profit. However, if the price of the asset falls, the trader will lose money. - Going Short

When a trader goes short on an asset, they are betting that the price of the asset will fall. If the price of the asset does fall, the trader will make a profit. However, if the price of the asset rises, the trader will lose money.

The flexibility of CFDs allows traders to take advantage of a wider range of market conditions. This can be a significant advantage, especially in volatile markets.

Accessibility

The accessibility of CFDs is one of the key factors that has contributed to their popularity. CFDs are traded on exchanges around the world, and they are available to traders of all levels of experience. This makes them a very accessible market for traders who are looking for a way to trade the financial markets.

- Trading Hours

CFDs are traded 24 hours a day, 5 days a week. This means that traders can trade CFDs at any time that is convenient for them. This is a major advantage over traditional trading markets, which have limited trading hours. - Global Reach

CFDs are traded on exchanges around the world. This means that traders can access the CFD market from anywhere in the world. This is a major advantage for traders who want to trade the global financial markets. - Low Barriers to Entry

CFDs are available to traders of all levels of experience. This is because there are no minimum account balance requirements to trade CFDs. This makes CFDs a very accessible market for new traders.

The accessibility of CFDs has made them a very popular trading instrument. CFDs are now one of the most traded financial instruments in the world.

Regulation

The regulation of CFD trading is an important consideration for traders, as it provides a level of protection against fraud and abuse. The CFTC and the FCA are two of the most respected financial regulators in the world, and their oversight of the CFD market helps to ensure that it is a fair and orderly market.

- Consumer Protection

The CFTC and the FCA have a number of rules in place to protect consumers who trade CFDs. These rules include requirements for brokers to be licensed, to maintain adequate capital, and to disclose all material information to their clients. These rules help to ensure that CFD brokers are operating in a fair and transparent manner. - Market Surveillance

The CFTC and the FCA also conduct ongoing surveillance of the CFD market to identify and prevent fraud and abuse. This surveillance helps to protect traders from being cheated by unscrupulous brokers. - Enforcement Actions

The CFTC and the FCA have the authority to take enforcement actions against brokers who violate their rules. These enforcement actions can include fines, suspensions, and even criminal prosecution. This helps to deter brokers from engaging in illegal or unethical behavior.

The regulation of CFD trading is an important factor that traders should consider when choosing a broker. By choosing a broker that is regulated by a reputable financial regulator, traders can help to protect themselves from fraud and abuse.

Risk

CFDs are leveraged products, which means that you can lose more money than you deposit. This is because when you trade CFDs, you are essentially borrowing money from your broker to trade with. If the market moves against you, you will be liable for the losses, even if they exceed your deposit.

- Margin Calls

When you trade CFDs, you will be required to maintain a certain level of margin in your account. Margin is a buffer that protects your broker from losses in case the market moves against you. If your margin falls below a certain level, you will be issued a margin call. A margin call is a demand from your broker to deposit more money into your account. If you fail to meet a margin call, your broker may close out your positions, which could result in you losing all of your money. - Volatility

CFDs are traded on margin, which means that they are highly leveraged products. This means that even small movements in the underlying market can magnify your profits or losses. This volatility can make CFDs a very risky investment, and it is important to be aware of the risks involved before you start trading. - Counterparty Risk

When you trade CFDs, you are entering into a contract with your broker. This means that you are relying on your broker to fulfill their obligations under the contract. If your broker becomes insolvent, you may lose all of your money. - Lack of Transparency

The CFD market is not as transparent as some other financial markets. This means that it can be difficult to get accurate information about the prices of CFDs and the risks involved in trading them.

It is important to remember that CFD trading is a complex and potentially risky activity. It is important to understand the risks involved before you start trading CFDs. You should only trade CFDs with money that you can afford to lose.

FAQs for CFD Trading in Las Vegas

CFD trading is a popular way to speculate on the price movements of various assets, such as stocks, indices, commodities, and currencies. However, it's important to understand the risks involved before trading CFDs. Here are some frequently asked questions about CFD trading in Las Vegas:

Question 1: Is CFD trading legal in Las Vegas?

Yes, CFD trading is legal in Las Vegas. However, it's important to choose a broker that is regulated by a reputable financial regulator, such as the Commodity Futures Trading Commission (CFTC) in the United States or the Financial Conduct Authority (FCA) in the United Kingdom.

Question 2: What are the risks of CFD trading?

CFD trading is a leveraged product, which means that you can lose more money than you deposit. It's important to understand the risks involved and to trade responsibly.

Question 3: How do I get started with CFD trading?

To get started with CFD trading, you will need to open an account with a CFD broker. Once you have opened an account, you can deposit funds and start trading CFDs.

Question 4: What are the benefits of CFD trading?

CFD trading offers a number of benefits, including leverage, flexibility, and accessibility. CFDs can be used to trade both long and short positions, and they can be traded 24 hours a day, 5 days a week.

Question 5: What are the different types of CFDs available?

There are a wide variety of CFDs available, including CFDs on stocks, indices, commodities, and currencies. The most popular CFDs are CFDs on the S&P 500 index and the EUR/USD currency pair.

Question 6: How do I choose a CFD broker?

When choosing a CFD broker, it's important to consider a number of factors, such as the broker's regulation, fees, and trading platform. It's also important to read reviews of different brokers before making a decision.

CFD trading can be a rewarding experience, but it's important to understand the risks involved. By choosing a reputable broker and trading responsibly, you can minimize your risks and maximize your chances of success.

For more information on CFD trading in Las Vegas, please visit the website of the Nevada Gaming Control Board.

Conclusion

CFD trading in Las Vegas is a popular and accessible way to speculate on the price movements of various assets. However, it is important to understand the risks involved before trading CFDs. CFDs are leveraged products, which means that you can lose more money than you deposit. It is important to choose a reputable broker and to trade responsibly.

CFD trading can be a rewarding experience, but it is important to remember that it is a complex and potentially risky activity. By understanding the risks involved and by trading responsibly, you can minimize your risks and maximize your chances of success.

Detail Author:

- Name : Anahi Heller I

- Username : okuneva.lou

- Email : haylee.wehner@hotmail.com

- Birthdate : 1971-12-16

- Address : 726 Strosin Fields Apt. 390 Maryambury, MT 52188-5871

- Phone : +1 (563) 998-1475

- Company : Hoeger and Sons

- Job : Team Assembler

- Bio : Temporibus quasi corrupti labore reprehenderit. Aperiam autem cum libero eaque ea. Sapiente atque fugit ea aut quae omnis id est. Iusto nobis totam quibusdam qui possimus dignissimos asperiores.

Socials

facebook:

- url : https://facebook.com/sanderson

- username : sanderson

- bio : Soluta quidem ipsa odit cum est non impedit assumenda.

- followers : 4304

- following : 1682

tiktok:

- url : https://tiktok.com/@savanah_anderson

- username : savanah_anderson

- bio : Et voluptas veniam recusandae pariatur commodi a numquam.

- followers : 4739

- following : 1506

linkedin:

- url : https://linkedin.com/in/anderson2009

- username : anderson2009

- bio : Dolor enim assumenda facere in odio.

- followers : 3091

- following : 2805

instagram:

- url : https://instagram.com/savanah.anderson

- username : savanah.anderson

- bio : Tempore autem dolores ut delectus. Eligendi officiis adipisci saepe ipsam ipsa.

- followers : 5761

- following : 1338

twitter:

- url : https://twitter.com/savanah_dev

- username : savanah_dev

- bio : Eveniet aut quam quisquam dolor praesentium. Dolor et quibusdam voluptas quia.

- followers : 6126

- following : 1037